IDEA

"International payments remain one of the biggest challenges for businesses. We needed a solution that bridges cryptocurrency innovation with traditional banking compliance, allowing companies to receive payments legally while reducing costs."

A fintech startup identified a critical gap in the international payments market: businesses worldwide needed a way to receive payments from international customers using crypto assets while ensuring full legal compliance and automatic conversion to fiat currency.

Traditional wire transfers were slow, expensive (8-15% fees), and often impossible due to banking restrictions. Meanwhile, direct cryptocurrency payments created legal and tax compliance nightmares for recipients.

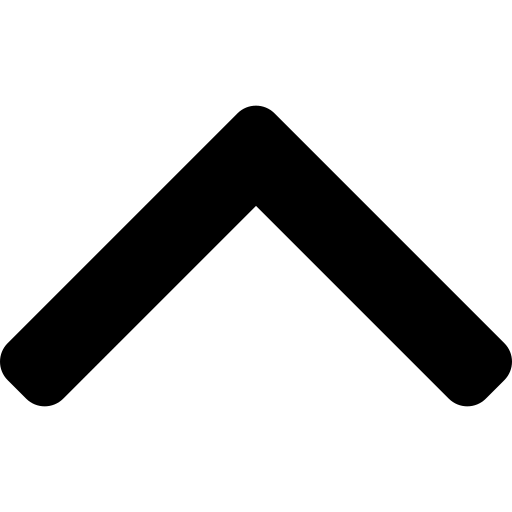

We developed a comprehensive platform that serves as a legal bridge between cryptocurrency payments and traditional banking, handling the entire process from crypto receipt to fiat delivery with full regulatory compliance.

Prototype

"The regulatory landscape was complex, but the technical team mapped out every compliance requirement while building the core engine. The platform feels like normal banking but with crypto benefits."

At the prototype stage, we delivered:

- Multi-currency crypto wallet infrastructure with advanced security protocols

- Licensed exchange integration APIs for automatic conversion

- Automated compliance and KYC workflows meeting regulatory requirements

- Real-time transaction tracking system with blockchain transparency

- Document generation engine for legal compliance and tax documentation

- Banking-like interface design for easy user adoption

MVP Development

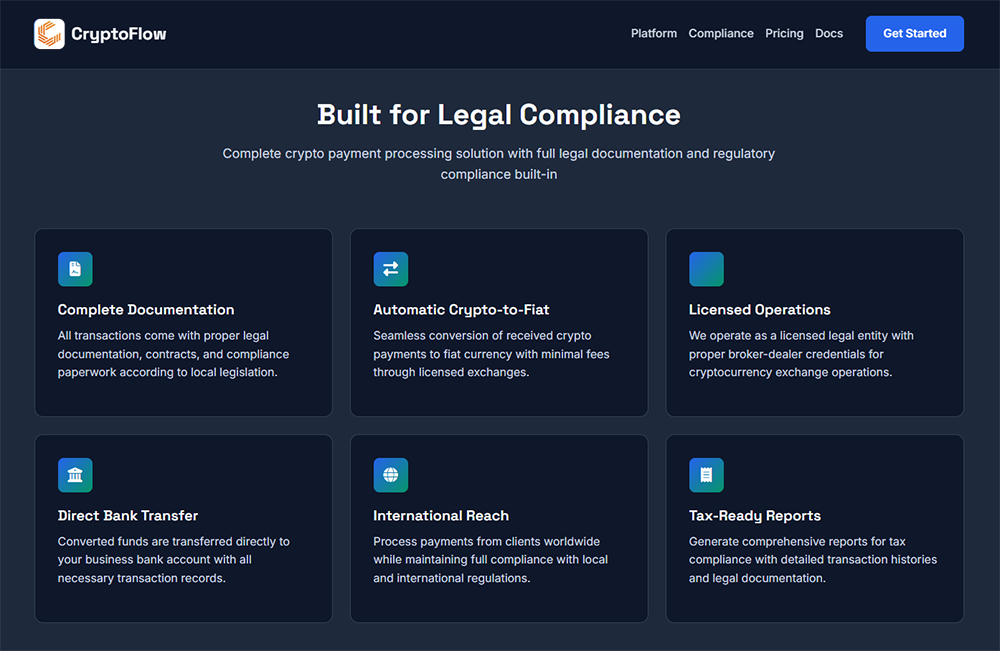

"Our MVP focused on the complete user journey — from invoice generation to bank account credit with all necessary documentation. Everything is fast, convenient and completely within the law."

MVP features included:

- Step-by-step invoice creation and instant sending to international payers

- Secure crypto payment processing with blockchain-based transparency

- Automatic conversion through licensed exchanges with up to 3% commission

- Direct bank transfers with complete legal documentation

- Role-based dashboards for freelancers, businesses, and enterprises

- Multi-language support for international users

- Mobile-responsive design for global accessibility

Functionality

- Automated workflow: Invoice → Crypto Payment → Exchange → Bank Transfer

- Licensed broker-dealer operations for cryptocurrency exchange

- Built-in KYC and compliance procedures

- RESTful APIs for e-commerce and financial service integration

- Multi-layer encryption for wallet management and security

- Cloud-scalable architecture with 99.9% uptime guarantee

- Real-time monitoring and transparent audit trails

- Integration with ERP and accounting systems

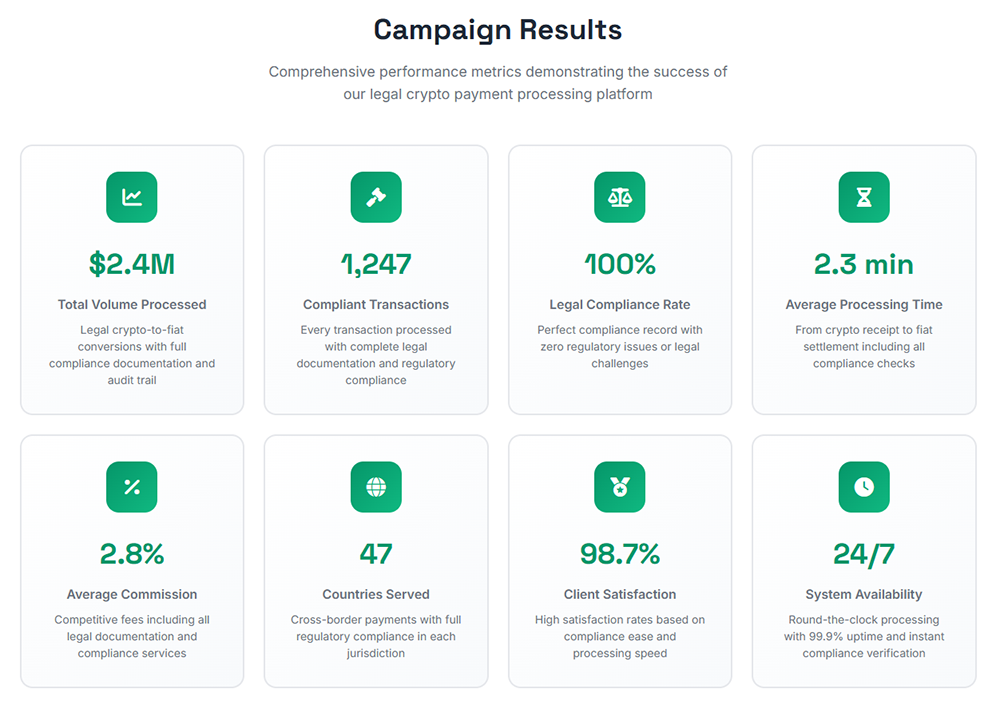

Results

- 1,000+ transactions processed within first 3 months of launch

- 40% reduction in payment processing time vs traditional methods

- Up to 3% commission vs 8-15% traditional international transfer fees

- 99.9% uptime maintained with zero security breaches

- 60% increase in international sales for enterprise clients

- Complete legal compliance with automatic documentation

- ROI improvement of 5-12x for businesses using the platform

Target Market Impact

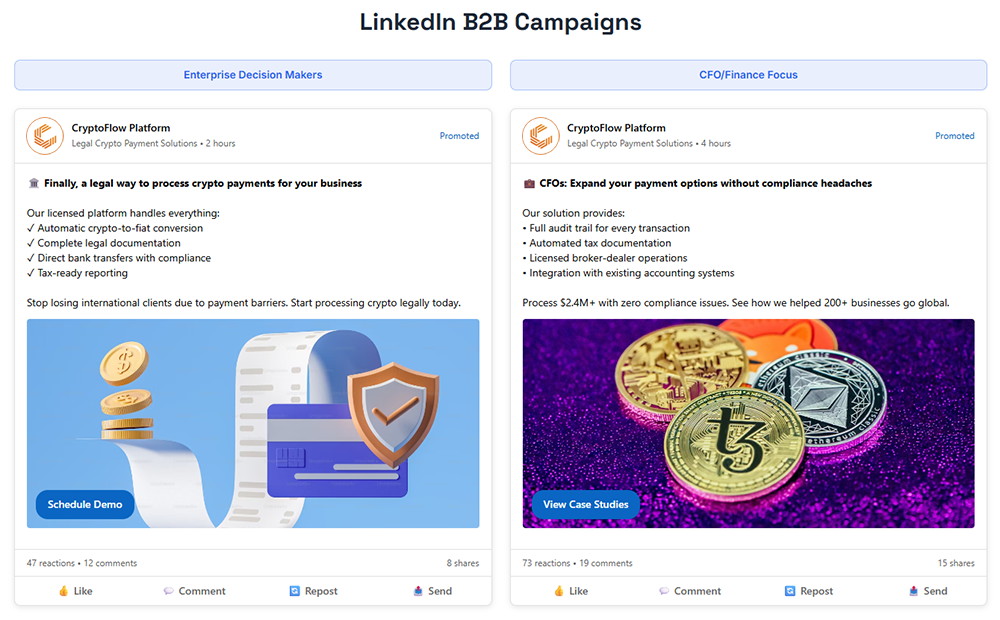

- Large Enterprises: Secure international payments without traditional banking delays

- Online Services: Expanded payment options without compliance burden

- Freelancers & Self-Employed: Legal international income with proper tax documentation

- Startups: International market access with professional payment infrastructure

- IT Specialists: Streamlined payments from global clients to local bank accounts

- Customers & Payers: Use crypto assets for convenient international transactions

Partnership

Ongoing collaboration includes:

- Enhanced compliance automation for evolving regulatory requirements

- Integration with emerging blockchain protocols and DeFi solutions

- Regular security audits and performance optimization

- Market expansion and compliance adaptation for additional jurisdictions

- Go-to-market strategy development for new regions

- Partnership development with financial institutions and payment processors

- Technical architecture consulting for scalability improvements